Why Ethical Contractors Embrace Marketing While Shady Ones Hide

I spent years working with construction companies in New Orleans before I realized something odd about my client vetting process… it didn’t really exist. In New Orleans, I could ask around. Someone always knew someone who’d worked with a contractor, and the network would tell me who to avoid. The informal vetting system worked because […]

Why Ethical Contractors Embrace Marketing While Shady Ones Hide

I spent years working with construction companies in New Orleans before I realized something odd about my client vetting process… it didn’t really exist.In New Orleans, I could ask around. Someone…

Stop Chasing Whales With a Rowboat

Contractors tell themselves they can’t land high-value clients because they don’t have the right relationships. Wrong. The relationship excuse is a comfortable lie that protects them from facing the real problem. When contractors finally get in front of whale clients, they get disqualified immediately. Not because of their work quality. Not because of their pricing. […]

Most Construction Companies Are Destroying Their Brand Voice

Brand voice isn’t just about consistency; that’s the baseline. Most companies treat brand voice like paint color. They obsess over matching the exact shade across every wall, every channel, every piece of content. The style guide gets thicker. The approval process gets longer. The content gets more predictable. The business results get worse. Here’s what […]

Marketing Consultant vs Fractional CMO – The Differences and When to Use Each

Construction leaders view the consultant versus fractional CMO decision as a choice between two equals. The actual decision is about whether you’re serious about making changes to your marketing or just checking a box. One delivers a plan. The other builds the system that makes the plan work. The Consultant Model Collapses at Implementation Marketing […]

How Small Construction Companies Beat Mega-Contractors at SEO

I’ve watched small construction companies make the same mistake over and over.They try to compete with mega-contractors for generic search terms like “Houston Construction.”This is a losing battle….

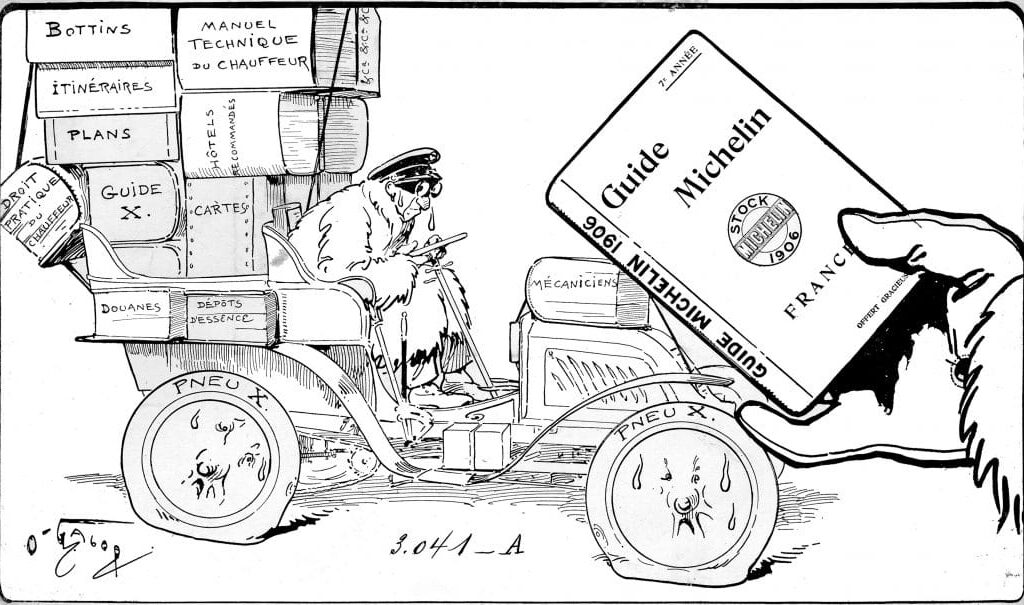

Content Marketing Isn’t New: What Construction Leaders Can Learn

If you think content marketing is just a buzzword of the digital age, think again. While it’s not widely used in the construction industry, content marketing has been influencing buyer decisions for over a century. Some of the most famous brands in the world use content not to sell, but to educate, entertain, and build […]

Stop Burning Money on Blind Bids

I watch construction companies burn $10,000 on proposals for projects they’ll never win. The math is brutal. Estimating, preconstruction, proposal design, executive reviews, etc. Real money and real time wasted to get what leadership calls “getting exposure”. Here’s a better alternative: Send the client $1,000 with a note saying, “Consider us next time.” You’ll save […]

How Founder-Led Sales Decreases Your Valuation

Your biggest asset might be your biggest liability. As a fractional CMO for construction companies, I’ve watched founders unknowingly slash their business valuation by 3-5x simply by being too central to their sales process. The math is brutal and straightforward. A construction company where the founder drives 60-80% of revenue might sell for 2x EBITDA. […]

Maximize Your Performance Using AltCMO Analytics Tools

Unlock the power of analytics and reporting tools to enhance decision-making and drive business success. Elevate strategies with data-driven insights today!